Billing and Payments

The City of Yorkton mails out property tax notices in late May every year. Property taxes are due on or before June 30.

Copies of assessment and tax notices

Email your request.

Payment options

There are many convenient ways for you to pay your property taxes.

Online |

|

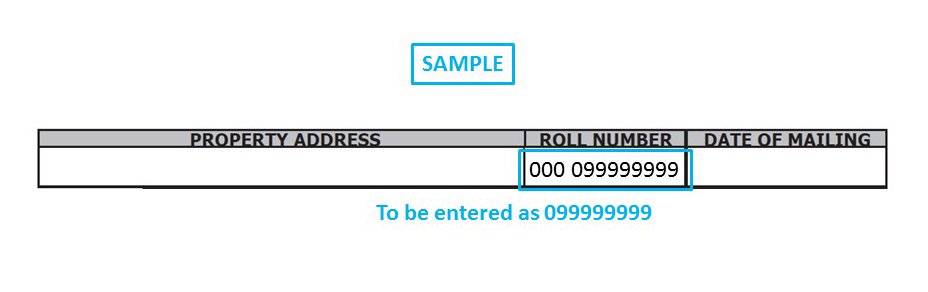

You can pay online through your financial institution using your nine-digit roll number. To avoid late charges, allow five days for processing.

|

In person |

|

You can pay at the cashier counter in the Financial Services department on the main floor City Hall. We accept cash, cheque, money orders or interact (debit) payments. We do not accept any credit card payments in person. Hours of operation Closed Saturday, Sunday and statutory holidays. |

Pay through your bank |

|

You can pay your tax bill at your bank or through their telephone or online banking services. You need your nine-digit roll number to make payments through your bank. Avoid late chargesTo avoid late charges, allow five days for processing. |

Pre-authorized monthly payments |

|

Our prepayment plan (TIPPS) allows you to pay next year's tax by automatic monthly withdrawals. It runs from July - June (taxes are due June 30th). Current year taxes must be paid in full before the end of June in order to start the prepayment program in July. How to applyComplete an application form and send it to us with a void cheque or deposit information from your bank. You can apply throughout the year. Payments are pro-rated based on when you enroll. Monthly withdrawalsYour monthly withdrawal is on the first working day of each month, beginning in July and ending in June. Payments are pro-rated based on the number of payments received before the due date.

If you would like your monthly withdrawal changed to a different bank account, you need to notify us. change your banking information Cancel the programIf you are selling your property, or want to stop having payments withdrawn, you must notify us. |

Credit card payment |

|

You can choose to pay your property tax by credit card online. Please note that this bill payment option is only available online. A convenience fee is charged for the use of this service. |

Pay at City Hall drop box |

|

After hours, you can pay by cheque using the drop box located in the main entrance inside the front door of City Hall. The mail slot is accessible during regular hours, Saturdays, Sundays and holidays. If you use this option, include your payment stub with your cheque. Make the cheque payable to the City of Yorkton. Do not put cash payment in the drop box. |

Late payments

Penalties |

|

Penalties are calculated according to our Penalty Bylaw. If you do not pay your current taxes in full by June 30, we will add 0.75% every month on whatever balance is outstanding. If your taxes are still unpaid after December 31, your property is in arrears and the penalty increases to 1.25% per month, and we will begin Tax Enforcement proceedings. |

Tax Enforcement |

|

The Citizens Guide to Municipal Tax Enforcement outlines the process municipalities must follow to collect property taxes that are in arrears. To aid in the collection of property taxes, we have adopted a Tax Enforcement Policy to outline the process, along with associated fees. The applicable fees are applied directly to the tax account.

|